The global natural gas market experienced a notable recovery in the first half of 2024,

with demand growing by 3% compared to the same period last year. This marks a significant

improvement following the supply shocks of 2022. However, despite this growth, challenges

remain, including supply constraints, rising gas prices, and geopolitical tensions that contribute

to price volatility. While global gas demand is expected to continue its upward trend in 2024,

growth is forecasted to moderate in the second half of the year, with Asia continuing to drive

much of the demand.

The first half of 2024 saw global gas demand increase by 3%, with the majority of this growth

(around 70%) occurring in the first quarter. Asia was the primary driver, accounting for about

60% of the increase, with countries like China and India seeing a rise in demand of over

10% year-on-year. Most of this growth was driven by industrial usage, particularly in

fast-growing Asian economies. Gas consumption in the power sector grew by a more

moderate 2%, and residential and commercial demand increased by 1%, boosted by

unusually warm temperatures in the first quarter.

Global LNG supply grew by just 2% year-on-year in the first half of 2024, with growth

largely concentrated in the first quarter. However, in Q2 2024, LNG output declined

by 0.5%, marking the first year-on-year quarterly drop since 2020. This decline was

caused by feed gas supply issues and unexpected plant outages. Despite this, LNG

supply is expected to grow in the second half of the year, with new liquefaction capacity

coming online. Notably, the U.S. is expected to lead the way in new export capacity,

with expansions at Freeport LNG, Plaquemines LNG Phase 1, and the expected

start-up of Corpus Christi Stage 3.

The decline in LNG supply and robust demand growth in Asia resulted in a tighter

global gas balance in Q2 2024, pushing prices higher across key markets. Additionally,

concerns about Russian gas supplies to Europe added to the volatility, leading to

increased gas prices in both Asia and Europe. In the U.S., Henry Hub prices surged

nearly 70% from March to June, recovering from their lowest levels in decades,

driven by upstream production cuts, higher gas-fired power generation, and

increased exports.

Global gas demand growth is expected to slow in the second half of 2024, falling to below

2% year-on-year. This slowdown reflects the gradual recovery that began in late 2023.

For the entire year, global gas demand is forecast to grow by 2.5%, primarily driven by

industrial demand, with only marginal growth in the power sector. While fast-growing Asian

markets and gas-rich regions like North America, Africa, and the Middle East will see increases,

European demand is expected to decline.

The supply of low-emissions gases is forecast to more than double by 2027, with significant

growth driven by policy support and investments in low-carbon technologies. Europe and

North America are expected to account for over 70% of this growth, though emerging producers

such as Brazil, China, and India are also expected to scale up their output. However,

achieving the full potential of low-emissions gas will require continued investments and

policy actions to meet ambitious global emissions reduction targets.

Tips for Effective Usage of BENTLY NEVADA

330901-00-40

The Bently Nevada 330901-00-40 is a cutting-edge control module engineered for

industries requiring high-speed data processing and immediate feedback. It boasts

an innovative design that ensures reliable operation under demanding conditions,

making it suitable for applications in chemical plants, power generation, and

manufacturing lines.Equipped with advanced algorithms, this module delivers

precise control over processes, optimizing performance and enhancing efficiency.

Its integration with Distributed Control Systems (DCS) enables seamless

communication and centralized management, ensuring smooth operation across

multiple systems.

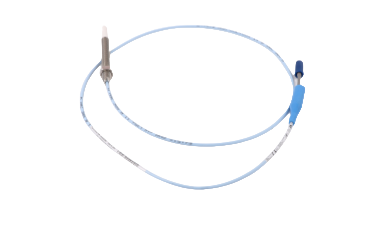

330908-00-28-10-01-CN

Experience unmatched precision with the BENTLY NEVADA 330908-00-28-10-01-CN

Proximity Probes. These sensors are meticulously designed for demanding industrial

environments, ensuring exceptional reliability and accuracy even under the most

challenging conditions.With a detection range up to 20 mm, these probes offer

flexibility in various applications, from machinery monitoring to automation systems.

They withstand extreme temperatures ranging from -40°C to +85°C, making

them ideal for harsh industrial settings.

330910-00-05-10-02-00

The Bently Nevada 330910-00-05-10-02-00 is a proximity probe designed for precise,

non-contact measurement of shaft displacement and vibration in rotating machinery.

Part of the 3300 series, this probe offers reliable performance in harsh industrial

environments, making it ideal for condition monitoring and predictive maintenance

applications. It provides accurate readings to help detect potential issues early,

thereby enhancing operational efficiency and reducing the risk of equipment failure.

The probe is designed for easy installation and integration with existing monitoring

systems, ensuring a seamless setup in various industrial applications.

The global gas market is recovering, with growth in demand and rising prices indicating a

strengthening market in early 2024. However, challenges persist, including supply constraints,

geopolitical tensions, and the need for continued investment in both traditional and low-emissions

gas production. While demand growth is expected to moderate in the second half of 2024,

Asia remains a key driver of the market. As the industry adapts to shifting energy demands and

climate goals, the future of gas will depend on balancing growth with environmental sustainability.